If you fail to respect risk, you will have a very short trading career.

“Don’t focus on making money; focus on protecting what you have.” – Paul Tudor Jones.

Paul Tudor Jones couldn’t have said it any better, as a trader risk management is key to any successful portfolio.

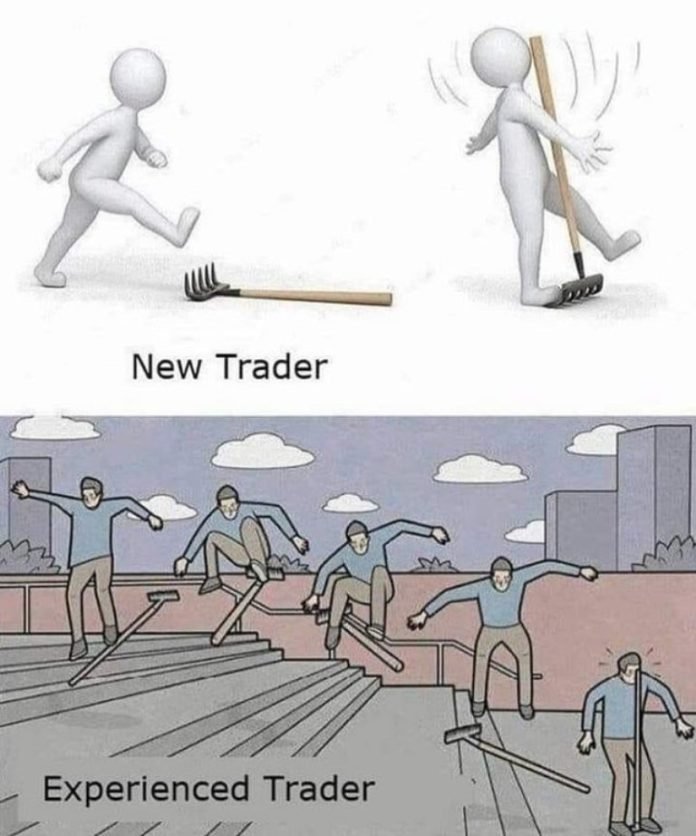

For any traders and investors who have been trading for a while, you will understand how important it is to manage you risk. For new traders,Risk Management is an area you should explore and learn about as you put together a trade plan and place early trades.

You may be thinking “surely, the greater the risk, the greater the rewards?” and this may be correct in some cases, but in the world of finance this mindset has been the downfall of many inexperienced traders and surprisingly even some industry “professionals”.

However, taking risk is what allows profits and the inability to take risks can limit profitability.

The point I am stressing is, you MUST have balance.

As traders, and also as individuals we all have different risk tolerances. While it may seem that the main goal of a trader should be to be profitable and make money (and that is what our many believe), unfortunately focusing simply on profitability will often cause traders to take unnecessary risk. This can lead to significant capital losses and without enough capital, your trading career will soon be over.

What you MUST UNDERSTAND is that your capital is the lifeblood of your trading, without it you have nothing.

Table of Contents

What’s the worst that could happen?

“I may blow an account; I go back to work and make some more money to trade with?”

Well, if you’re like myself and many others, where trading is our full-time job, we have no other options, blowing an account would be disastrous and would mean we would have to cease our operations, which believe it or not has happed to MULTI-BILLION DOLLAR institutions by “professional” traders.

For example, Barings Bank, England’s first investment bank founded in 1762 became a victim to the poor Risk Management decisions, allegedly made by employee Nick Leeson and possibly by others even higher up in the bank.

Nick Leeson was a derivatives trader and had rose through the ranks at the early stages of his career at Barings. By the age of 28 he became Head of the banks operations at the Singapore International Monetary Exchange (SIMEX). However, Leeson eventually lost over £1 billion of the company’s capital, with the losses allegedly hidden in an error account called the Five Eights Account, “88888”.

Whilst Leeson was in Singapore, he was primarily trading futures on the Nikkei 225, the main Tokyo index, however, at times he struggled. And as a result of this, his losses quickly multiplied.

Leeson was allegedly “secretly” using the bank’s money to speculate on the market , to make back huge losses. By late 1994, Leeson’s account had losses of just over £208 MILLION.

His hopes to win the money back failed miserably in early 1995 when the Kobe earthquake hit Japan and the Nikkei 225, which he BET would recover, FELL very sharply and very quickly.

Trading losses amounted to well over £1 BILLION, which was more than twice Barings available capital and as a result of this Barings Bank ceased operations and became insolvent.

Following the collapse of England’s oldest investment bank, Leeson served six-and-a-half years in prison!

Well… How Can Traders Eliminate Risk?

If I am being 100% honest, WE CANNOT.

But what we can do is MANAGE RISK and UNDERSTAND ITS IMPORTANCE.

Here I am going to look at some simple Risk Management strategies that can be used to protect your trading capital.

The 1% Rule!

A lot of traders, including myself follow what is called the 1% rule. Basically, what this means is that you should NEVER put more than 1% of the capital in your account, or Assets Under Management (AUM) into a single trade. For example; if you have £10,000 in your trading account, your position in any given asset should not risk more than losing £100.

You will find this strategy is very common for traders with smaller accounts of below £200,000, although some traders may risk 2% if they feel comfortable with a trade.

However, if managing or trading an account over £200,000 – I would highly recommend going with a lower percentage. You will find larger retail and institutional traders will risk no more than 0.75% of their AUM per trade.

Diversify!

Ever heard the saying “Don’t put all your eggs in one basket.”? This has for a long time been great advice within the financial industry for ensuring that you hold or trade a variety of assets.

For Example: If you put all your capital in one asset, you are potentially setting up for a big loss if a trade doesn’t go your way. This is a very common mistake made by inexperienced traders. So, remember DIVERSIFY the assets within you’re trading portfolio.

Not only does diversification help manage risk, but it also opens up other opportunities.

Stop-Loss and Take-Profit!

Of the two, a Stop-Loss is in my opinion one of the most important risk management tolls. A Stop-Loss is the point at which a trader will take a loss on a trade, and this most often happens when a trade does not go as the trader expected. The main point of a Stop-Loss is to prevent the “it will come back eventually” mentality and limit losses before they spiral out of control and you end up exceeding your 1% rule!

On the other hand, a Take-Profit is the point at which a trader will take a profit on a trade, and this is usually set at a key price level of an asset where the trader believes the momentum driving the asset in his/her direction will stall. For example; if a currency is approaching a key level of resistance after a large move to the upside, traders will want to sell before the price starts to reverse and erode their profits.

A very popular way to place both stop-losses or take-profits is at key support or resistance levels, which can be inserted on a price chart by connecting previous highs or lows that occurred on significant, above average volume.

The Bottom Line…

Solid Risk Management is the decider to either success or failure as a trader. As we I have looked at, regardless of what stage you are at in your trading career, if you do not respect risk it will bite, and before you know it, you will be left with NO CAPITAL, NO BUSINESS, and NOTHING TO SHOW.

So, if I can give any advice it would be simply RESPECT RISK and I hope this article has opened your eyes to the importance of Risk Management.